Marketing for Insurance Companies — 17 Tips for Instant Results

To thrive in the insurance business, it is essential to have a robust marketing strategy that can enhance brand recognition and connect with potential customers. Learn 17 proven tips that can improve your marketing strategy.

Ever scroll through your feed and see an insurance ad that's... kinda boring?

It's like the digital version of elevator music – there, but not really grabbing your attention. Just a kind of background post that stops you from getting to the good stuff.

And hey, that's a problem. In today's world, if you're not standing out, you're blending in, and that's no good for your insurance company.

But as a marketer for insurance companies, how the heck are you supposed to stand out among influencers, memes, personal posts from friends, and the 24-hour news cycle? What insurance marketing ideas are out there that help you beat your competition?

Well, it's actually not as hard as you may think, especially when you have a toolbelt of strategies at your disposal.

See, insurance marketing can be tricky because it requires a lot of effort to connect with people. But what if we flipped that script? This isn't about theory; it's about giving you those 'aha!' moments that lead to serious results.

By the time you finish reading, you'll have a whole new set of tools to make your insurance marketing unforgettable. We're talking about strategies that build trust, get you those sweet leads, and make your company the one people actually talk about.

Sound good? Let's ditch the boring and make your insurance marketing shine.

Refine Your Email Marketing Strategy

First, the power of email. Despite ads, viral videos, and catchy TikToks, email marketing remains one of the most effective ways to market a business - insurance companies included.

See, email marketing has an average ROI of around 3600%, or $36 for every $1 spent. On top of that, 80% of marketers would rather scrap their social media marketing strategies than ditch email, and that says something.

Think of it this way: 99% of users check their email every day, and there are 4.4 billion email users worldwide. This means you have a direct line to your consumers, one they'll check every day, and you can speak directly to them via personalization.

Do not skip this strategy. In most cases, it'll be your most effective marketing strategy for connecting with consumers directly.

So, how do you use it to your advantage to move the needle for your insurance company?

Let's break it down.

- Break it down, build it up

Picture your customer list as one big crowd. Now, start dividing those folks into smaller groups – people with similar needs, similar policies, and even similar ages. Why? Because no one wants a generic email that could apply to anyone. Sending the right message to the right group makes it way more likely they'll actually care.

- It's all in the name (and a few other details)

Sure, using your customer's name in the greeting is standard. But let's level up. Did you have a quick call with them last month? Mention that. Do you know they just renewed their auto policy? Reference it! It may seem small, but it signals to your customers that you see them as individuals.

- Be the teacher, not just the salesperson

Insurance can be confusing. Use your emails to break things down, answer common questions, and even bust some industry myths. This helps people feel empowered as customers, and guess what? Empowered customers trust you more.

- Test, test, and test again

We wish there was a one-size-fits-all magic email formula, but there isn't. So, try different things! Experiment with snappy subject lines or serious ones. Send a long-form article one week and a quick infographic the next. See what works for YOUR audience and double down on it.

- Timing is everything

Sending the perfect email at 2 AM? Probably won't get much traction. Experiment with sending times until you figure out when your people will likely open and engage.

Remember, a great email strategy isn't built in a day. Keep learning, tweaking, and most importantly, listen to what your customers respond to.

READ ALSO: 4 High Converting Email Marketing Templates Your Audience Will Love

Tap Into the Power of Video Marketing

Video is HUGE, and guess what? It's not just for viral cat videos anymore.

Smart insurance companies are using it to connect with people on a whole new level. Why? Because video can do what plain text can't. If a picture is worth 1,000 words, video content is worth a million.

Take Geico Insurance, for example. 1.87 million subscribers. 11.3 million total views. Imagine having that kind of reach? Well, they got it, all through the power of video marketing. And to note, as of 2024, 82% of internet traffic is video content, so yeah, you can't ignore this.

Just take a look at this ad from Geico again. 4.1 million views. Well worth the investment.

So, how do you create a video marketing strategy? Let's break it down:

- Tell stories that stick: People love stories. Did a policyholder make it through a tough time because of their insurance? Did someone finally get that confusing policy term thanks to your explainer video? Let those stories shine on screen!

- Make insurance feel less...insurancy: Let's be real, insurance policies aren't the most thrilling read. But a short, animated video breaking down a tricky concept? These kinds of insurance marketing ideas are way more engaging and way less intimidating for potential customers.

- Put a face to your company: Testimonials aren't just for websites anymore. A short clip of a real customer sharing their positive experience builds way more trust than a written quote ever could.

Pro Tip: Don't forget about search! Adding keywords to your videos' titles and descriptions helps people find them on Google and YouTube. It's like extra marketing magic.

Mini Action Plan:

- Brainstorm: What stories can you tell? What questions do customers always ask?

- Don't Be Fancy: Good content beats expensive gear. Start with your phone if needed!

- Share, Share, Share: Website, social media, emails... get your videos out there.

- Track those Stats: Did a video lead to a surge in quote requests? You'll want to know!

Video is a powerful tool, but like any tool, it's how you use it that matters. Put your customers' needs first, be authentic, and a little creativity goes a long way!

Capitalize on Content Marketing

While email and video content are taking though, it still (somehow) hasn't replaced the power of blog posts, or content marketing. Every time someone searches for an answer online, they're shown blog content.

But let's be honest, people aren't reading full blog posts. Even this in post, you're scrolling through to see what stands out, an answer that resonates with you. That's what your customers are doing to. They value, and they want answers.

Here's the process.

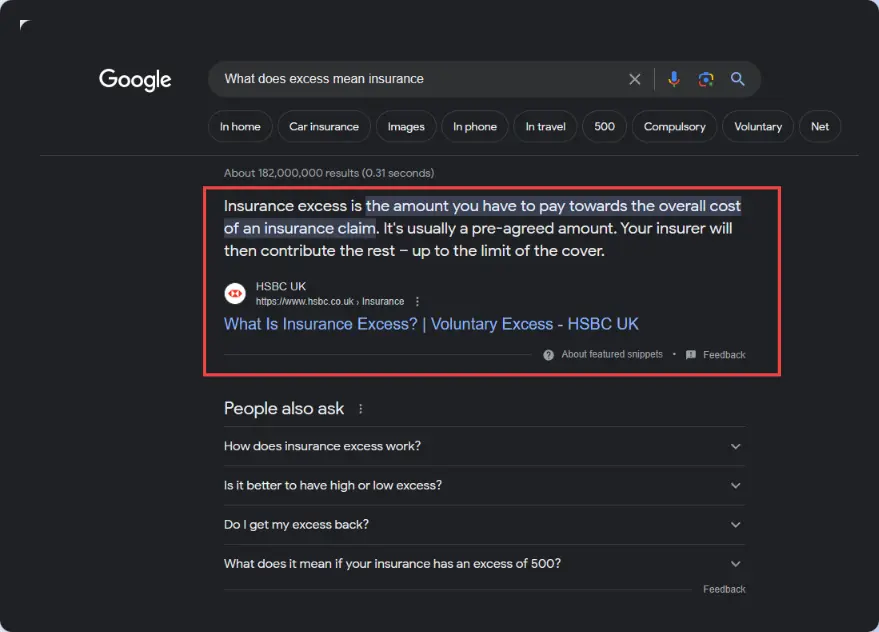

- Consumer has a question. Let's say they want to know what "excess" means.

- They head over to Google or Bing and search "What does excess mean?"

- They see a screen that looks like this;

They get the answer, but they might click to read a little more if they need clarity.

Your job in content marketing is to get your answer at the top of the search so people are clicking your content. The higher you rank, the more authoritative you become as a business, and the more of a leader you are within the insurance industry, the more sales you'll make.

TL:DR—Give your audience stuff they actually want. Blog posts, guides, videos—things that answer their questions, solve their problems and make them see your insurance company as the expert.

Here's how to make it happen:

- Step 1: Know your people. This isn't guesswork. Think about your ideal customer. Are they new homeowners? Small business owners? What keeps them up at night? What are they confused about? Your content needs to address those things.

- Step 2: Get organized. Insurance marketing isn't a "whenever-you-feel-like-it" thing. Create a calendar! Plan ahead for timely posts (think tax season, hurricane prep, etc.), and make sure you actually stick to it.

- Step 3: Variety is the spice of life (and good content). Don't just write blogs! Listicles, infographics, and even downloadable checklists can appeal to different audiences.

- Step 4: Play nice with Google. SEO sounds technical, but it's important. Using the right keywords in your content helps people find you when they're searching for answers.

- Step 5: Teach, don't preach. No one likes a pushy salesperson. Use your content to provide value! Explain how insurance works, share tips on reducing risk, and help people even if they're not ready to buy today.

Expert Tip: Track those numbers! Did a blog post get shared like crazy? That tells you what your audience likes. Did another one fall flat? Time to try something different.

This stuff takes time, but the payoff is big. With the right content, you're not just another insurance company anymore – you're the place people turn to for trusted advice.

SEO: Your Secret Weapon for Getting Found

Bringing all these content marketing strategies for insurance together, one umbrella concept you need to be thinking about throughout is SEO, or Search Engine Optimization.

Whatever content you're putting out, search engines (which is how 81% of consumers start their journey) will rank you on how helpful that content is and will categorize you. Are you providing real, unique, authentic value?

You get ranked high.

Are you mass AI-generating blog posts to fill space that simply regurgitates information that's already out there in a non-unique way?

You'll be ranked as spam and pushed down the rankings. Also, you can use Conversational AI to Manage Customers in Insurance.

Important Note: As of March 2024, Google is updating its algorithm to crack down on AI, low-value, spam content. This means websites with a ton of AI content will be penalized. Sure, you can use AI to help produce content, but you can't just generate and post. You need to provide unique value, perspective, or insight. Make every piece as comprehensive and complete as possible.

And on that note, it's better to have five absolutely stellar blog posts for your SEO that bring real value to your readers than it is to have 100 generic posts. Quality of your user experience is the most important factor you have to consider.

Every single time. With every video. With every blog post.

It's not just about showing up – it's about showing up when people are actually looking for what you offer. Here's how:

- Know the magic words: People aren't typing "best insurance possible." They're typing "affordable car insurance [city name]" or "What insurance do I need as a landlord?". Figure out those specific terms your customers use, and use them in your website content.

- Think local: Insurance is often about where you live. Are you an agent with a brick-and-mortar office? Is your specialty insuring businesses in a particular region? Make sure search engines can tell that, so you show up for the right searches using local search engine optimization too!

- Content is still king: Google rewards websites that answer people's questions well. That means blogs, FAQs, and even downloadable guides can work SEO magic.

- Don't forget the tech stuff: A beautiful website that takes forever to load won't get you far. Same goes for a site that's a nightmare to navigate on a phone. User experience matters for SEO, too!

- Build those links: Think of this as other websites vouching for you. Can you guest post on a relevant blog? Get a mention on a local news site? Each quality link back to you helps boost your authority.

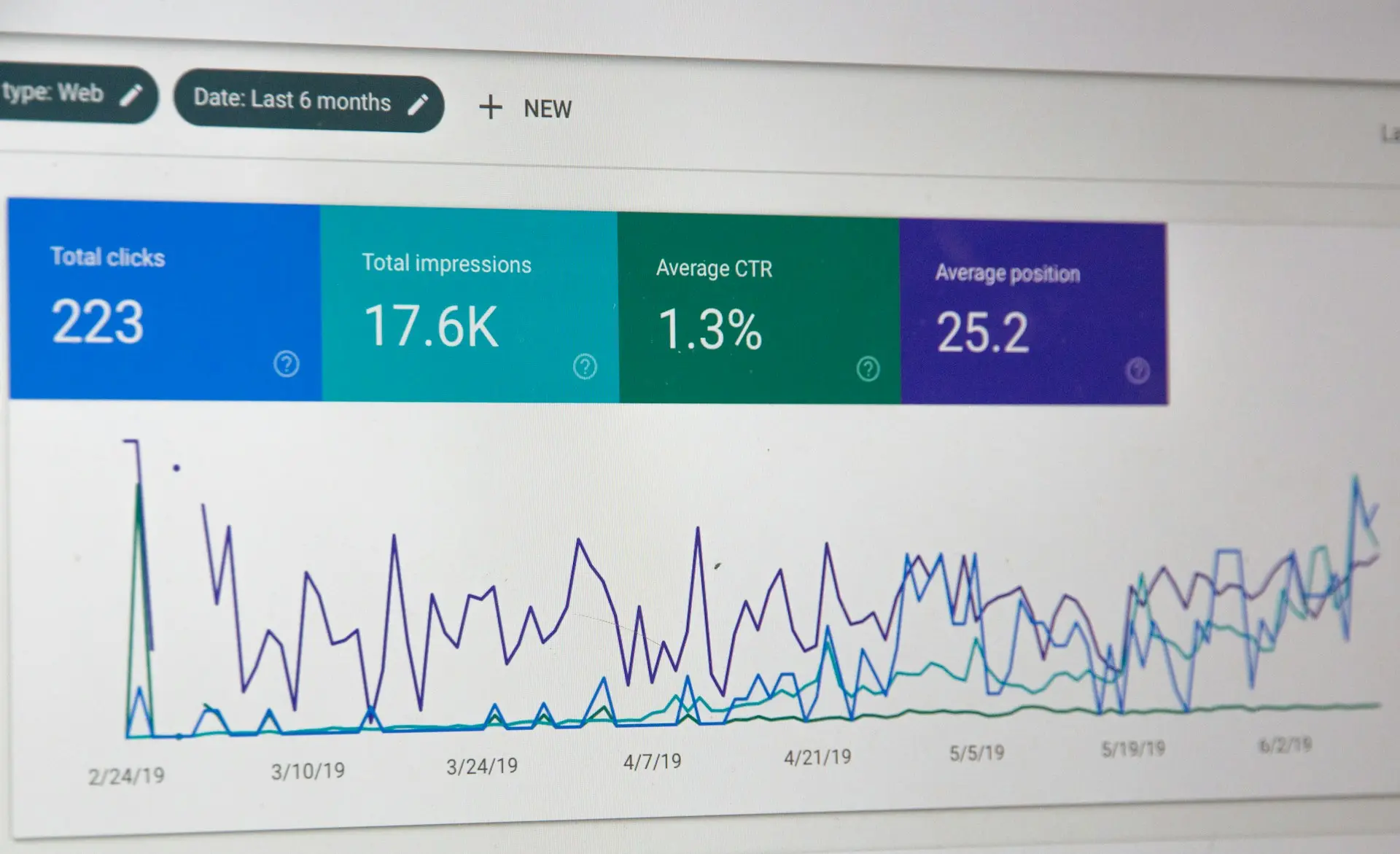

Pro Tip: SEO is a long game. Don't expect to rank #1 overnight, but don't give up! Tracking your results lets you see what's working and refine your strategy over time. Cut out or update posts that don't work, and double down on what does.

Investing in SEO isn't a quick fix, but it's one of the smartest ways to ensure a steady stream of qualified leads coming your way.

Team Up with Bloggers (They've Got the Audience, You've Got the Expertise)

Think of bloggers and influencers like popular kids at a new school – they already have a crowd of people listening to them. Partnering up with the right ones puts your insurance company right in the mix with folks who might not have heard of you otherwise.

Here's how to make this work:

- Be picky: Don't just reach out to anyone with a blog about... anything. Do your research and find people that fit your branding and target market. Find content creators who write specifically about insurance or related topics (like personal finance or homeownership). Their audience is already primed for your message.

- Start as a fan, not a salesperson: This is about building relationships. Follow the blogger on social media, comment thoughtfully on their posts, and maybe even share something they wrote.

- Make your pitch personal: No copy-pasted emails! Reference something specific they wrote and tailor your suggestions for how you could work together to what YOU know they're interested in.

- What's in it for them? Don't just ask to be featured for free. Offer something valuable! It could be an interview with your company's top agent, a free tool you've created, or behind-the-scenes data they won't find anywhere else.

- It's a two-way street: Be open to collaborating! Can you guest post on their blog? Do a joint webinar? Brainstorm ways you both benefit.

Expert Tip: Blogger outreach won't show results overnight. Think of it as nurturing a long-term connection that can pay off big time as they grow their audience, and you establish yourself as an authority!

Social Media: Your Direct Line to Customers

Okay, let's address the elephant in the room — social media.

Social media can feel like a wild jungle, especially for insurance agencies and companies. But here's the thing: it's also where your potential customers hang out, asking questions, sharing worries, and looking for solutions. It's up to you to meet them there.

- Don't be everywhere, be strategic: You don't have to conquer every single platform. Figure out where YOUR ideal customers are most active. Is it LinkedIn for business owners? Facebook groups for new parents? Focus your efforts there.

- Stand out, but in a good way: Your social media voice should match your overall brand. Are you friendly and approachable? Super professional? Be consistent, so people know what to expect.

- Be a real person! Social media isn't for faceless corporations. Respond to comments, answer questions, and thank people for sharing your content. This builds way more trust than just blasting out ads.

- Give stuff away (no, not insurance policies): What do your customers need? A checklist for buying a first home? Tips on lowering risk as a business? Share that knowledge freely, and they'll see you as an expert they can trust.

And here's a social media power move.

Got a happy customer? Ask if you can share their testimonial (anonymously is fine!) A genuine review is worth more than ten ads.

Oh, and don't forget the numbers.

All those likes, shares, and comments tell a story. Are specific posts hitting the mark? Are people mostly clicking on your ads in the evenings? Use these tips to maximize your Facebook ads' performance.

Produce and Distribute Comprehensive Information Sheets

Think of information sheets like cheatsheet power-ups for both you and your customers. They answer common questions, cut through the confusion, and leave people feeling like they actually understand this insurance stuff.

Here's how to make yours awesome:

- Solve their problems, not yours: It's tempting to just cram policy features onto a page. Instead, start with questions your customers ask all the time. "What's covered under homeowners?" "How do deductibles work?" Make a sheet for each topic.

- Speak human, not insurance-ese: Jargon is the enemy. Pretend you're explaining things to your friend's mom who knows nothing about insurance. Short sentences, simple words, and even the occasional friendly joke can make your info sheets stand out.

- Pictures are worth 1000 policy words: Can you turn a confusing process into a flowchart? Could an infographic compare the cost of different plans? Make it visual! What's more, infographics can increase traffic by up to 12% and are 30 times more likely to be read all the way through compared with blog posts!

- Pros make it look polished: Don't let bad formatting ruin good info! If you're not a designer, hire one. Outsource and focus on quality. Your sheets should be clear, branded, and professional-looking.

- Spread the word: Don't just stick them on a website page and forget about them! Add them to emails, share them on social, and have your insurance agents hand them out... Get them in front of as many potential customers as possible.

Expert Tip: Information sheets are secret marketing weapons for your insurance agents, too. A simple, clear explainer they can give to clients builds confidence in your company and makes their job easier!

These aren't just boring documents; they're trust builders. When a customer feels empowered about their insurance choices, that's a win for them AND for you.

Give Something Amazing, Get Amazing Leads

We're talking lead magnets next.

Sure, they're not a silver bullet to your marketing efforts, but they're kinda close. Think of it this way: you're giving away a little piece of your insurance expertise for free in exchange for the chance to connect with someone who needs what you offer.

You're showcasing that you know what you're talking about, you have value to offer, and your consumers should certainly come to you if they want to know more.

But that freebie has to be GOOD. Here's the recipe:

- Answer THE question: Don't make a generic guide that anyone could find online. What's the one burning question your ideal customers keep asking? "How to Choose the Right Business Insurance" is way more enticing than "Business Insurance Basics."

- Think like a customer, not an insurance agent: Would YOU find this useful? Does it tell you exactly what to DO next? Write your lead magnet like you're giving advice to a confused friend.

- Make it a mini-sales pitch: Subtly weave in why your company is the perfect solution to the problem your lead magnet addresses—not in a pushy way, but naturally—because you really are the best solution, right?

- Pretty is powerful: A sloppy-looking PDF won't inspire confidence. Invest in good design for this. It makes a world of difference as to whether people actually download the thing!

- Don't be stingy with the signup: Yes, you want their email address but don't ask for their whole life story in exchange for the download. First name, email, and MAYBE their business name is enough to start.

Pro Tip: Promoting your lead magnet is just as important as creating it! Put a link everywhere – social media, website, even your email signature. Shout out to the world (not in a spammy way) that you have free, helpful content ready to give right here, right now.

Remember, a great lead magnet does more than get you contact info. It leaves people thinking, "Wow, if their free stuff is this good, imagine what it's like to actually WORK with them!" Using lead magnets to convert blog readers could be very effective.

Host an Event They Won't Forget (and that Gets You New Business)

Insurance networking events can be…let's just say, not the most exciting. But done right, they're a way to build buzz, get face time with ideal potential clients, and even forge partnerships that help your company grow.

Let's break it down:

- Why are we even doing this? Figure this out first. Are you mostly aiming for new leads? Strengthening relationships with existing clients? Knowing your goal determines everything from who you invite to what type of event you plan. At the end of the day, this isn't a strategy for every insurance agency.

- Ditch the boring formats: Panel of experts? Open Q&A? Even a speed-networking session for quick intros can be more engaging than the usual cocktail party with stale sandwiches.

- Location matters: Your fancy office boardroom might feel safe, but is it inspiring? Look for unique venues that make the event itself feel special (without breaking the bank).

- Get the word out (to the right people): Who NEEDS to be there? Don't just blast out invites – tailor your message to why each person or business will benefit by attending your insurance agency meet-up.

- Make connections happen: Awkward silences won't lead to new policies. Plan activities that force people to mingle – icebreaker games, problem-solving challenges... get creative!

Expert Tip: The follow-up is where the real sales magic happens. Did you pick up on any potential leads during the event? Don't wait – reach out with a personalized message referencing something you talked about.

Events aren't just about free drinks (though those are nice). They're about showing your company is a dynamic part of the community and, most importantly, filled with people potential customers WANT to work with.

Want Happy Customers? Make Them Your Sales Team (Yep, It's That Easy)

Aka - implementing lucrative referral programs.

Referral programs are like a secret weapon in the insurance world... and way more fun than actual secret weapons. Quite simply, this is an effective insurance marketing strategy because someone outside your business tells your target audience what you do is worth checking out.

It's their reputation on the line, and people trust it. Of course, you, as an insurance business, will say that what you have to offer is good, but when people outside your business are pointing at you, this leaves a mark.

And the stats back this up. Word-of-mouth recommendations are 2 to 10 times more likely to work than a paid ad, and 69% of consumers with a positive experience are likely to recommend you to another person. Leads from a referral network also have a 30% higher chance, on average, to convert.

READ ALSO: Referral vs Affiliate Marketing — What Is the Difference?

A great way to encourage these referrals is by setting up your own referral network or program.

Here's how to make yours work:

- Make it worth their while: No, seriously. Offering a measly 5% discount won't get anyone excited. Can you offer cash? A chunk off their next renewal? A gift card to a place they actually like? Don't be stingy!

- Keep it ridiculously simple: Don't make them fill out complicated forms or jump through hoops. A shareable link they can text to friends? Ideal.

- Shout it from the rooftops: Well, not literally. But don't hide your referral program on some buried website page! Put it in your newsletter, mention it during calls, and remind happy customers they could be earning rewards.

- Don't forget the rules: Ugh, regulations are a pain. But make sure upfront that your program is legal in your area. Nobody likes getting their hopes up and then being let down.

- Track those results: Is one type of reward way more popular than others? Are you getting referrals from unexpected places? Use that data to make your program even better!

Pro Tip: THANK people when they refer someone, even if that person doesn't sign up. It's common courtesy and keeps them feeling good about your company.

The best thing about referrals? Those leads are already warmed up. They've heard good things from someone they trust, so you're starting the conversation way ahead of the competition.

PPC: Get In Front of People the Moment They're Looking to Buy

PPC (pay-per-click) ads are like digital billboards but way smarter. You're only paying when someone actually clicks, and you can make sure those clickers are the right people through trial and error. Here's how to make it work:

- Know your goal: Are you trying to get more people on the phone? Filling out a quote form? Selling a specific type of policy? This isn't just about clicks; it's about actions.

- The right words = the right customers: Don't waste money on generic terms like "insurance." Do keyword research to find out what people are actually typing into Google when they need insurance like yours.

- Sell the click: Your ad isn't just an announcement; it's a sales pitch! What problem does your insurance solve? Include a clear call to action ("Get a free quote today").

- Don't be a stalker... but be smart: Target those ads carefully! There's no point in paying to show car insurance ads to someone in a city with great public transit.

- Budget wisely: Start with a small, manageable budget so you can test and learn. Once you know what works, then you can scale up.

Expert Tip: Don't just dump people who click onto your homepage! Create dedicated landing pages that match your ad perfectly. Make it clear what they need to do next.

Also, Track Everything!

Clicks, cost per click, how many people actually buy... this data isn't just interesting; it's the key to optimizing your ads and getting the best bang for your buck. By being strategic and constantly testing and tweaking, you can turn those clicks into paying customers.

YouTube: Become THE Insurance Channel People Actually Watch

Back to YouTube now because it deserves a shoutout.

If you can nail YouTube, you're opening the door to potentially reach millions of people. And the higher you can, the further that reach can take you. However, making sure your YouTube content isn't a snoozefest takes work and consideration.

You need to find your niche, figure out what your target audience wants, how to present it to them in a way that works for them and make it engaging. Are you formal and to the point? Does a casual, funny, Millennial approach work better?

Make sure the content you create is your own, and create a brand that people want to connect with.

- Find your superpower: Are you amazing at explaining complex policies? Do you have a knack for making insurance relatable? Lean into what you do best, and build your content around that.

- Make a schedule and stick to it: Regular uploads are key to growing an audience. Even once a week is better than random uploads whenever you feel like it.

- Invest in the basics: No, you don't need fancy studio equipment. But good lighting, clear audio, and some basic editing software will make a world of difference.

- Be a real human: Don't just recite boring policy details. Have a personality! Are you friendly and warm? Super professional and authoritative? Let that shine through.

- Search matters here, too: Just like with your website, figure out the keywords people are searching for and use those in your video titles and descriptions.

- Spread the word: New video dropped? Share it EVERYWHERE – socials, website, email newsletter... don't be shy!

Pro Tip: Pay attention to comments! Are people asking the same confusing question? Boom, that's your next video topic. Your audience practically gives you insurance marketing ideas!

Once again, don't expect overnight results, as YouTube takes time, but the payoff as an insurance marketing strategy can be huge. When people need insurance advice, your channel could be the first place they look, building trust way before they even contact your insurance agency.

Get on the Podcast Mic (& Be a Guest!)

Podcasts are a fantastic way to show that your insurance agency isn't just about policies – it's about real people with real expertise who genuinely want to help. And with over 100 million active podcast listeners in the US (about a third of the population)

Here's how to make an impact:

- Find your voice... literally: Do you have a soothing explainer voice? Are you the kind of person who could make actuarial tables sound interesting? Don't try to be someone you're not – that makes a great podcast stand out.

- Solve their problems: Don't just talk about insurance; talk about how it helps people in real-life situations. Can you do a "Mythbusters" episode? Interview potential clients with unusual claims? Get interesting.

- Gear matters (but not too much): Yes, listeners should be able to hear you clearly. But if you're constantly fiddling with fancy equipment, it screws up the flow. A decent mic and basic editing software are enough to start.

- Be a regular: Weekly, monthly, whatever... pick a schedule you can actually maintain. It's better to have a great episode every other week than to rush out low-quality content.

- Get out there!: List your insurance agency podcast on every platform possible and promote it everywhere your new leads and existing customers are. Make it as accessible as possible.

Pro Tip: Being a guest on other podcasts is an amazing way to reach a new audience. Target shows that serve a similar customer base (target audience) to yours and bring your A-game in terms of valuable content.

Directories: Get Found by People Ready to Buy

Think of online directories as the Yellow Pages of the digital age, but smarter. People use them when looking for your type of insurance, so it's important to be there! Also, authoritative directories give your website quality backlinks, significantly boosting your SEO.

Here's how to dominate these listings:

- It's not just about quantity: Do your research. Which directories do your ideal customers actually use? What directories show up on the first page of Google results in your area? Focus on those first.

- Claim your power: Many directories have free listings. Claim those ASAP, even if you just fill out the basics for now. This prevents wrong info from showing up!

- Fill it ALL out: Accurate info matters (your address, hours, etc.), but don't neglect the description section! Use keywords and highlight what makes your agency special.

- Online reviews rule the world: Encourage happy customers to leave online reviews on your listings. This is social proof that builds trust before people even visit your website.

Pro Tip: Check your listings regularly. Did a competitor leave a fake negative review? Is your phone number wrong? Fixing issues quickly keeps your listings working for you.

Directories might not be flashy, but they're a consistent source of qualified leads. Invest a little time upfront, and reap the rewards as people searching for insurance in your area find YOU first.

Your Newsletter: The Secret to Staying Top-of-Mind

Email newsletters are your direct line to your customers, but only if they actually read them. Here's how to create newsletters they won't hit delete on:

- Know your people: Don't blast out the same newsletter to everyone. Are some subscribers homeowners and others renters? Do you have a lot of small business clients? Segment your list so you can send relevant stuff.

- Make it a treat, not a chore: Nobody wants to wade through a wall of text. Break up your newsletter with useful tips, infographics, and even the occasional funny meme (if it fits your brand!)

- When to send is just as important as what to send: Experiment a little! Is Tuesday morning a dead zone, but Thursday afternoon gets a ton of clicks? Use that data!

- Be reliable: Decide on a schedule and stick to it. Monthly, biweekly, and even weekly works if you have the content to back it up. Consistency is key.

- Eye-catching but not annoying: A clean layout that's easy to read on a phone is a MUST. Too many colors, fonts, or flashing GIFs will get you sent to spam.

- What do you want them to DO? Every newsletter should have a purpose. Want them to read a new blog post? Get a quote? Make that call to action super clear.

Pro Tip: Ask for feedback! A quick poll or "Did this help?" question at the bottom keeps your audience engaged and lets you know what content hits the mark.

And don't forget, newsletters aren't about hard-selling. They're about reminding people that you're there, you're an expert, and you genuinely want to help. Do that consistently, and the sales will follow!

Get Noticed with Shorts (Yes, Even Talking About Insurance Services!)

Shorts are like snacks for the internet – quick, satisfying, and easy to share. And quite simply, statistics show that a staggering 96% of consumers would rather watch short-form content to learn about a product or service than any other kind of content, so yeah. Don't sleep on this.

For insurance, they're a way to cut through all that boring jargon and show you get it. Here's the recipe:

- The first three seconds are everything: Start with a bang! Is it a crazy insurance fact or a relatable customer struggle? Don't waste time with a slow intro—jump right in.

- Make it pop: Bright colors, big text overlays, and fast cuts grab attention as people scroll. You don't need fancy effects, just energy!

- Trends are your friend. Is there a popular sound or challenge you can adapt to insurance? If you ride the trend wave, your shorts will be in front of more eyes.

- Captions aren't optional: Most people scroll with the sound off. Make sure your message is clear even without audio.

- Don't just talk – SHOW: A quick timelapse of cleaning up a flooded basement is way more engaging than just explaining water damage coverage. Get creative!

- Tell them what to do next: "Like for more tips" "Visit our website," "What questions do YOU have?" Don't leave people hanging.

Pro Tip: Post your Shorts everywhere – TikTok, Instagram Reels, even YouTube Shorts. Each platform has a slightly different audience, but once you've made the content, get proper mileage from it by getting out to the world.

And once again, never forget to track and analyze your results! Did a funny one get a ton of shares? Did a serious one spark a bunch of questions? Analyze what works and do more of that. Stop guessing what works and hoping for the best. That's how you waste precious resources.

Like these other insurance marketing efforts and strategies, getting short-form content right takes practice, but they're a powerful way to reach a new audience and show that your insurance company isn't just about policies – it's about people.

CallPage: Your Lead-Generating, Time-Saving Secret Weapon

Let's be real, insurance sales mean a ton of calls and messages. Even if you try just a few of the killer strategies we talked about, that's a serious time suck.

You want to give customers a great experience, but... how do you connect with those actually interested in what you're selling? After all the work of getting those leads, don't mess it up now!

That's where CallPage swoops in to save the day. This simple but effective lead capture tool takes your website traffic and converts it into leads 24/7! Check out how it will change the way you do local lead generation:

- Capture more leads from your website: Don't let potential customers slip away! With CallPage, you can catch 'em while they're hot (using smart trigger rules), offering instant callbacks or the option to schedule a chat later.

- Improve response times: CallPage helps you respond to leads in 28 seconds or less. Yes, you heard that right! Faster responses mean happier customers and a better chance of closing that deal.

- Automate the boring stuff: Let CallPage handle the routine tasks, like scheduling calls and managing callbacks. This way, you can focus on what really matters — talking to customers and growing your business.

- Call recording and analytics: Want to get even better at phone calls? Record them and analyze what you did right and wrong. That'll help you improve and close more deals. To make it easier, CallPage offers automatic transcriptions of all your conversations.

- No more time wasted: CallPage works seamlessly with your current software. Say goodbye to juggling apps or copying info by hand.

Pro Tip: CallPage isn't just about new leads. Stay top-of-mind with current clients, too! Renewal reminders, birthday texts... little touches build relationships and keep you #1.

Think of CallPage as the newest member of your team. It frees up your agents to sell, sell, SELL – while making the whole lead generation thing easier than ever.

READ ALSO: 10 Lead Conversion Strategies to Boost Your Sales Process

Key Takeaways: How to Dominate in Insurance Marketing

- Customers are in charge: They're online. They're doing their own research. Meet them where they are, with content and tools that actually help them.

- It's not about you; it's about them. Focus on solving your customers' problems, not bragging about your insurance agency.

- Variety is key: There's no single magic marketing tactics. A successful insurance marketing strategy means using the right mix of high quality content, social media, paid ads, email... it all works together.

- Data is your best friend: Track, analyze, and adjust! What works today might not work in six months. Staying on top of trends and results keeps you ahead of the competition.

- Don't give up. Marketing takes time and effort. But building those relationships and establishing yourself as an authority in your niche pays off big time in the long run.

FAQs

How do I market my insurance company in a way that actually works?

The best insurance marketing focuses on two key things: building trust and making things easy for your customers. This means providing valuable content that answers their questions and solves their problems. It also means having a website that's clear and user-friendly, with tools like online quote forms.

Technologies like CallPage can streamline communication, making for a smoother experience for both leads and your team. By becoming the go-to resource for reliable insurance information and advice, you'll naturally attract more customers.

How can I get people excited about my specific insurance products?

Focus less on product features and more on the real-world benefits your insurance provides. Instead of just listing policy details, talk about how your coverage protects customers from unexpected events, gives them peace of mind, and lets them focus on what matters most.

Testimonials from happy clients are also powerful, as they show how your products have made a difference in people's lives.

Millennials hate insurance, right? How do I reach this audience?

Millennials don't hate insurance, they hate feeling confused, condescended to, and ignored. To market to this demographic effectively, you need to meet them where they are. This means having a strong digital presence with a mobile-friendly website and being active on the social media platforms they use.

Explain things clearly, ditch the jargon, and use visuals to make complex concepts easier to understand. Millennials also want to do business with insurance agencies that share their values, so don't be afraid to highlight your commitment to sustainability or social responsibility.

Conclusion

The insurance world is changing fast. But with the right insurance marketing strategies, it's changing for the better! By focusing on your customers' needs, embracing new technologies, and getting creative with your content, you're not just keeping up – you're setting the pace for the whole insurance industry.

Here's the thing: it's not about doing everything. It's about doing the right things well. Focus on building genuine connections, becoming the trusted resource your customers need, and staying adaptable as technology and trends change.

The tools are out there.

Smart companies like yours are using them to build relationships, streamline processes, and make it easier than ever for people to get the coverage they need.

Ready to level up your communication and watch your leads grow?

CallPage could be the missing piece.

The insurance agency of tomorrow isn't just selling policies. It's creating an experience. Let's get started!

Start generating leads today!

Start a 14-day free trial now,

set up the widget on your site, and see how many more leads you can capture with CallPage

- No credit card required

- 10 minutes set up

- 14 days fully-features free trial